According to Luna Jaffe, lesbians can use resourcefulness instead of resources to build a life of plenty.

Luna Jaffe is in love with money. And she wants to share the love with her clients, especially those who don’t think they’re good at managing their own finances. Jaffe, a financial planner who lives with her partner in Portland, Ore., says that her profession puts her in touch with a whole spectrum of people, including many lesbians.

To coach and advise them, Jaffe uses skills from her earlier lines of work—she was a fine artist and a therapist before becoming a certified financial planner—to help clients take a creative approach to money. She says, “I see women choosing to be more resilient, even if they’re living on a minimal income. I teach clients to use their resourcefulness instead of their resources to build a life that has plenty in it.”

For example, Jaffe describes Megan, a client from Texas,* “who’s operating as if she has a fair amount more money than she does. I told her she couldn’t afford to draw down on the accounts she has by more than $5,000 per year because if she did that she would be out of money by the time she’s 72. That didn’t make her feel good, but it’s actually motivated her to say, ‘OK, I do have to keep working, because I want to go to the Michigan Womyn’s Music Festival this year.’ I’m going too, so that means I have to work extra days before I go and extra days when I get back.

“Megan made a good choice. She’s learning where she’s willing to compromise and where she’s not. Giving up the Michigan festival was not a choice she was willing to make. Instead, she decided to sublet her apartment and move in with a friend for six months, to save that expense and have more freedom. She had that ability to make choices and act on them.

“But putting her head in the sand and saying, ‘La la la, I’m going to the festival on my credit card’ would not have been a good idea. That kind of thing is very common, but it’s not fiscally responsible.

“Another couple was just here—one is 61 and her partner is 54. They’re both super-fit. They weigh about 100 pounds each and they bike 100-mile races together. One of them, Bree* is a vet with a large animal sanctuary, and she wants to retire in two years. Her partner, Barbara*, is really attached to the working world, but they’ve both talked about wanting more time to be together and to be doing things together that are not about the rat race. So I did some projections to see what would happen if they both retired in five years, and it turned out that they could both live very comfortably. Bree was a little stunned. She said, ‘Really? I could stop working in a few years?’ I told her that not only could she stop, but the projections show that if she lived till she was 100, she’d have several million dollars left as long as Barb didn’t live to be 120!

“So I get to play both sides. For some clients, I get to say, ‘You don’t have to work for the rest of your life,’ and with other people, I have to say, ‘You’re not being realistic about your money. You have to make choices.’ ”

Along with coaching clients who want to increase their wealth, she also encourages those who want to become resourceful without using money. She says, “I’ve seen some success when women become entrepreneurial with their homes. Air B&B is one of the best ways to do that. I’ve also seen people sharing or swapping houses. For example, I have some friends who have a half-acre of land around their house, and so they invited their neighbours to garden in their yard. They all work on it together, and they all harvest it together. They want to live with great food.”

Does everyone need a financial advisor or planner? “Honestly,” Jaffe says, “most people could benefit from it if they were willing to make it a value and put their money into it. In other words, it’s like asking, Do you invest in your own wellness program? Most of us would benefit from taking excellent care of our bodies through both fitness and nutrition, though some of us need that more than others because some of us are naturally more fit than others. And the same is true for money. We all have a body, and we all have a relationship with money.

“First, though, let’s make the distinction between a financial advisor and a financial planner. A financial advisor usually is going to work with you only if you already have assets to manage. So, typically, you can hire a financial planner to develop your financial literacy, as well as get a clear picture of where you are, where you want to go, and how you want to get there. There’s also a money coach, who helps you become accountable. A coach is a good choice for somebody who has no assets and is trying to get to a [different] place, whether you are getting out of debt or just navigating the day-to-day, month-to-month, dollars-and-sense stuff.”

Finding the right financial consultant takes time and effort, Jaffe says. “The best way is to ask for referrals from people. So you call a minimum of three [potential advisors] and have a conversation, asking: How do you work with people? What is your background? Why do you do this work? And always ask how they’re paid. Anybody who dodges that question should be eliminated from the list, because it’s important.

“After you’ve asked those questions, had those conversations, when you leave that office, do a body check and note how you feel in your guts, because a lot of times people are very condescending, or they talk over you, or they make you feel judged. Even if their words aren’t judgmental, you might have a feeling of having been judged—and you don’t want to work with that person! It’s just not a safe place, so you won’t open up, and then you’ll be missing a lot of the juiciness of doing the work if you don’t feel that you can be vulnerable.

“People ask me, If you’re in the LGBTQ community, shouldn’t you work with somebody in the community? My answer is that it’s less important to work with somebody who is in the community than it is to work with someone who understands the community. There are some very good planners out there who are straight, but who really get it, and are aligned with the LGBTQ community. To me, the question is: How well do they understand the issues that we have? If they get it, then good!”

Some of the issues specific to gay women, Jaffe says, include the complexity of how lesbian relationships begin and end. Until recently, we haven’t had the legal structures that have been available to straight couples. So the joinings and endings can be very messy.

“An interesting thing is happening now that [gay] people can get married. There’s a bit of a rush to get married, without an understanding that you have to get divorced if you don’t stay together. So I like to talk to people about how those choices impact their money.

“Another challenge for lesbians is about beneficiaries, being clear about what you are doing with your legacy. We might not necessarily want to just pass everything along to family, because the family hasn’t always supported us. But if you don’t do estate planning, if you don’t pay attention to whether your beneficiary designations are named, you may be giving to your family only because you defaulted on that responsibility.

“People have the opportunity to be charitable with their beneficiary designations. If you’re single, for example, and have no kids, is there an LGBTQ organization that you are particularly fond of? Why not support it, why not put your money back into the community that has been benefitting you or has worked toward things you care about?” (lunajaffe.com).

Luna’s Laws

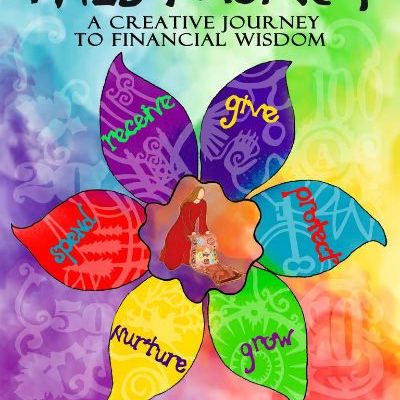

Receive Money with Grace

Money comes into our lives in many ways, but do you ever stop to think about how it feels and what impact those feelings have on the inflow of money? Shifting your attitude and awareness in this arena can dramatically change the flow of money in your life.

Spend with Intention

In the world of electronic banking and credit cards, it’s hard to feel connected to the money you spend. Recognize triggers for unconscious spending and replace old habits with new, healthy, sustainable actions so that more of your money is nurtured, grown, and protected.

Nurture Your Nest Egg

This mandate implores you to take stock of your past assumptions about saving and investing so you can create ways to keep your tucked-away money warm and growing.

Give with Guts

Examine your patterns of giving, the underlying emotions, and the impact your giving has on you. This mandate inspires sustainable giving practices that align with your values and gives you permission to care for yourself while also serving the world.

Protect Your Wild Places

Know how to respond to a personal financial crisis and be prepared for the unexpected. Protect your income, assets, and family by understanding insurance products and estate planning. Assess what areas need to be shored up and how to prioritize competing needs.

Grow Your Gold

No one would plant a garden with only one crop because it’s risky, not to mention boring. Yet, many do exactly this with their portfolios. Shift out of fear and into curiosity and learn how to plant, tend, and prune your investments.

From Wild Money: A Creative

Journey to Financial Wisdom by Luna Jaffe (Fortunity Press 2013)

*Names have been changed